The differences between an IPO (Initial Public Offering) and Private Equity are significant in terms of how capital is raised, the impact on ownership, regulatory requirements, and overall business strategy. Here’s a breakdown of the key differences:

Access to Capital

IPO: Capital is raised by filing a registration statement with the SEC to offer shares to the public, meaning anyone can buy stock in the company. This can result in significant amounts of capital, often in the millions or even billions, depending on the company’s valuation. IPOs can be successful for companies of any size, including small cap and microcap companies, though the amounts raised largely determine which underwriters will back the IPO.

Private Equity: Capital is provided by a select group of institutional investors or private equity firms, without selling shares to the public. While the amount can also be large, it typically comes from a limited number of investors rather than a broad public pool.

Ownership and Control

Photo: Unsplash.com

IPO: Going public means selling equity to many shareholders, which dilutes ownership. Founders and original owners often lose control, especially if a significant portion of shares is sold. Public companies are accountable to shareholders, who can influence decisions.

Private Equity: While ownership is still diluted, private equity investors often take a more active role in management, but the company remains privately held. Founders and owners retain more control compared to an IPO but must work closely with the private equity firm, which may push for changes in management or strategy.

Regulatory and Reporting Requirements

IPO: Public companies are subject to strict regulatory oversight by bodies like the SEC and FINRA. They must file 10-Qs quarterly and 10-Ks annually, and any material events must be disclosed in 8-Ks. This adds significant administrative and compliance costs, as each filing requires the review of securities attorneys, accountants and PCAOB auditors.

Private Equity: Private companies backed by private equity are not required to follow the same reporting requirements as public companies. There is much more privacy and less public scrutiny, as they are not subject to the same regulatory oversight.

Timeline and Exit Strategy

IPO: Going public through an IPO can often take 6 months to a year and involves significant preparation, including hiring securities attorneys, accountants, and auditors to prepare the necessary financial disclosures. The investment bank underwriting the IPO must also conduct roadshows to attract investors. Once public, the company has continuous access to capital markets if the company keeps its SEC filings current.

Private Equity: Private equity investments are typically made with the goal of exiting within 3 to 7 years. The exit might occur through a sale, merger, or even an IPO. The process of securing private equity investment is generally faster than preparing for an IPO.

Liquidity

IPO: Once the company goes public, its shares are traded on a stock exchange, like NASDAQ or the NYSE, providing immediate liquidity for shareholders who can sell registered free trading stock through their brokers. Founders and early investors can sell their shares (subject to lock-up periods), and employees with stock options can also benefit.

Private Equity: Private equity does not offer the same level of immediate liquidity. Founders and shareholders typically cannot sell their shares until the private equity firm exits the investment, often through a sale or another liquidity event.

Public Scrutiny vs. Operational Privacy

IPO: Public companies are subject to intense public scrutiny. Quarterly earnings reports and disclosures are watched closely by analysts, investors, and the media. This pressure can push companies to prioritize short-term performance over long-term growth.

Private Equity: Private equity-backed companies enjoy greater operational privacy. Since they are not required to make public disclosures, they can focus on longer-term strategic goals without the pressure of meeting quarterly earnings expectations.

Cost

Photo: Unsplash.com

IPO: The IPO process is expensive, requiring investment banks, legal teams, accountants and PCAOB auditors. Underwriters typically take 3% to 7% of the raised capital, and significant ongoing SEC compliance and reporting costs add to the financial burden.

Private Equity: While private equity deals also come with costs (such as legal and financial advisory fees), they are generally lower than IPO costs. However, private equity firms often take a percentage of profits (known as carried interest) once they exit the investment.

Involvement in Operations

IPO: After going public, a company’s board of directors and executive team typically retain control over day-to-day operations. Shareholders may influence major decisions, but management largely runs the company.

Private Equity: Private equity firms often play a more hands-on role in the business. They may introduce new management, change the strategic direction, or push for cost-cutting measures to improve profitability before they exit the investment.

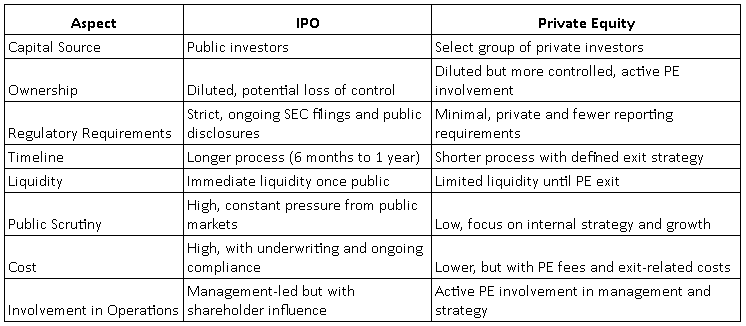

Summary of Differences Between an IPO and Private Equity:

Conclusion

Choosing between an IPO and private equity depends on your company’s growth stage, capital needs, and the level of control and public scrutiny you’re willing to accept. Both options provide valuable pathways for growth but come with distinct trade-offs. Entrepreneurs should carefully weigh these factors and consult with an experienced securities attorney to determine which route ideally aligns with their business goals.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute legal, financial, or professional advice. The content discusses the differences between raising capital through an Initial Public Offering (IPO) and Private Equity but should not be considered as a recommendation or endorsement of any specific financial strategy. Before making any decisions related to IPOs, private equity, or other capital-raising methods, it is essential to consult with qualified legal, financial, or investment professionals who can assess your unique business circumstances and provide personalized guidance. The authors and publishers of this article are not responsible for any actions taken based on this information.

Published by: Holy Minoza