Summary

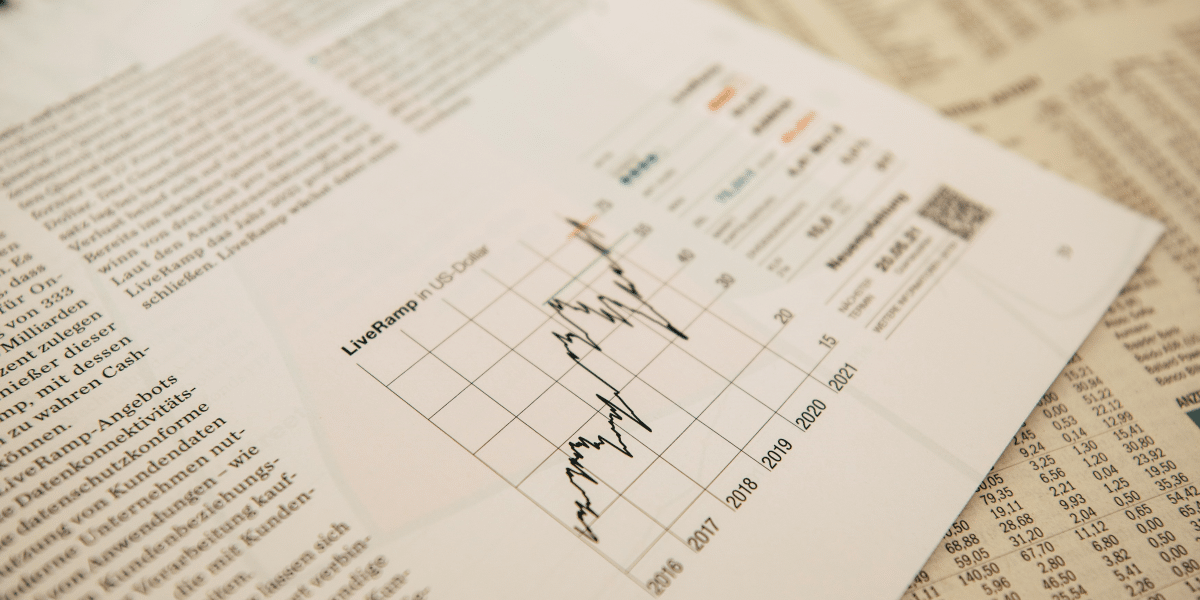

The financial industry is undergoing a seismic shift, owing to the potent capabilities of Generative Artificial Intelligence (AI) and large language models like ChatGPT. In an in-depth discussion with Hariom Tatsat, an authority at the crossroads of AI and finance, we unpack how these innovations are revolutionizing not just client interactions but also complex aspects like financial planning and risk mitigation.

About Hariom Tatsat: A Visionary in the Confluence of AI and Finance

Hariom Tatsat wears multiple hats, serving as Vice President at a New York Investment Bank and authoring the seminal work “Machine Learning & Data Science Blueprints for Finance.” His expertise serves as a compass for professionals venturing into the integration of finance and AI.

The Evolutionary Leap: Generative AI in Finance

Generative AI models like ChatGPT, Stable Diffusion, and Typecast have amassed millions of users in a very short period, changing how we interact with technology. But their application goes beyond general usage; they offer a paradigm shift in the financial industry. As Hariom Tatsat puts it, these models transition from using existing data for predictions to actually generating new, actionable insights.

User Experience

Generative AI technology promises a sweeping transformation of the customer experience in the banking sector. Its data analysis capabilities allow it to deliver highly personalized customer service in real time. From providing tailored financial advice and targeted product suggestions to proactive fraud detection, Generative AI offers a user-centric approach that essentially reduces support wait times to zero. It effectively guides customers through the complex processes of onboarding, identity verification, and product selection.

Automating Routine to Enhance Efficiency

Generative AI is not merely a support tool; it’s an efficiency enhancer. By automating routine tasks like account balance checks and password resets, it frees customer service reps to tackle more complex issues. The 24/7 availability of such services extends help to customers outside traditional banking hours, thereby creating cost efficiencies for financial institutions without sacrificing customer satisfaction.

A Game Changer in Digital Banking

AI technologies, from natural language processing to predictive analytics, are revolutionizing customer experience in digital banking. Personalized financial advice, automated customer service, robust fraud detection mechanisms, and enhanced decision-making processes are just some of the areas where AI is making a significant impact.

The Convergence of AI and Human Expertise

As Generative AI tools become increasingly sophisticated, they will also enrich the skillsets of remaining professionals in the sector. For example, a UX designer empowered by AI can make more informed choices quickly, thus enhancing productivity and overall efficiency.

Game-Changing Use Cases of Generative AI in Banking

Here’s where the rubber meets the road. Generative AI and similar models have the potential to fundamentally alter how banking services are consumed and provided:

Account inquiries: Customers can use chatbots for real-time updates on account balances, transaction history, and other account-related data.

Money transfers: Seamless fund transfers to other accounts or merchants can be executed through conversational interfaces.

Loan applications: These bots can streamline the application process for loans, providing step-by-step guidance to customers.

Credit score monitoring: With real-time alerts and suggestions, chatbots can help users maintain or improve their credit scores.

Financial advice: Beyond just information retrieval, chatbots can offer investment advice based on market data and user profiles.

Fraud prevention: By monitoring transactional activities, chatbots can flag suspicious activities, adding an extra layer of security.

Customer service: Frequently asked questions or simple issues can be efficiently resolved through automated systems.

Account management: From setting up automatic payments to updating personal information, chatbots can manage various facets of account maintenance.

Insurance claims: Users can employ chatbots to initiate the claim process and to stay updated on their status.

Financial planning: Budgeting and goal-setting can be personalized and automated, with the chatbot offering timely reminders and tips.

These capabilities are just the tip of the iceberg. The application of generative AI can extend to areas like algorithmic trading, risk assessment, and even regulatory compliance in the future.

Human-AI Collaboration: The Best of Both Worlds

While the utility of generative AI in financial services is undeniable, Tatsat cautions against viewing them as a complete replacement for human professionals. He envisions a future where AI and human experts work in harmony, each amplifying the other’s capabilities.

Roadblocks and Future Endeavors

There are challenges, such as ethical considerations, data security, and model accuracy. But organizations like OpenAI are proactively mitigating these through techniques like reinforcement learning through human feedback (RLHF).

Looking Ahead: The Future is Generative

With advancements in machine learning and AI, the next 20-30 years are set to be groundbreaking. Generative AI could evolve to tackle more complex financial issues, making the sector more efficient and consumer-friendly.

Conclusion

The intersection of AI and finance promises to be an exciting frontier, teeming with opportunities for innovation and enhanced efficiency. Generative AI and large language models like ChatGPT are not just fascinating technological developments; they are catalysts for systemic change in the financial industry.

Published by: Martin De Juan