Image commercially licensed from: Unsplash

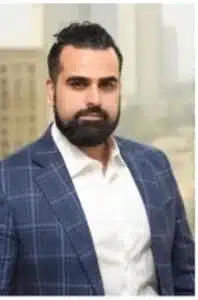

When investing in commercial real estate, your first decision is determining the property type you will purchase. Many different vehicles are available for investors, and the target investment type must match your goals and desires. Ali Choudhri, CEO of Jetall Capital and one of Houston’s largest private real estate owners, lays out what options are available and what to consider when getting started in this Jetall University post.

There are many types of commercial real estate, and depending on your risk tolerance, investment capacity, financing method and desired outcome, some may be a perfect fit, and some may not. First, let’s review commonly available options:

1) Office Buildings: Investing in office buildings involves purchasing properties designed and used primarily for commercial office spaces. This can include multi-tenant office buildings, corporate campuses, or even single-tenant properties. Consider factors such as location, occupancy rates, existing tenant lease terms, and demand for office space. Covid has impacted commercial office space, with some cities reflecting a slower return to the traditional office environment. Yet that presents an opportunity as well.

2) Retail Properties: Retail properties include shopping centers, strip malls, standalone retail buildings, or mixed-use developments with retail components. When buying retail properties, factors such as location, foot traffic, tenant mix, demographics, lease terms, age of structure and façade, and the overall health of the retail sector in the regional area are important considerations. Ecommerce has, of course, impacted traditional retail, but that change also created opportunity. For example, malls suffer while City Center-type concepts are thriving.

3) Industrial Properties: Industrial properties encompass warehouses, distribution centers, manufacturing facilities, and flex spaces. These properties cater to businesses involved in logistics, storage, manufacturing, or other industrial activities. Factors you need to consider are location, proximity to transportation routes, lease terms, demand for industrial space, and the local economy.

4) Multi-family Properties: Multi-family properties are residential buildings with multiple units, such as apartment complexes or condominiums. Investing in multi-family properties can provide a steady stream of rental income. Consider location, occupancy rates, rent potential, property management, and the demand for rental housing in the area. Remember that the multi-family business also has many aspects to that part of the industry. Some people build and design, others manage directly, some hire management companies, etc.

5) Hospitality Properties: Hospitality properties include hotels, resorts, motels, or other lodging establishments. Investing in this sector involves considerations such as location, tourism trends, average daily rates (ADR), occupancy rates, competition, and the overall health of the hospitality industry in the area. Many hotel owners do not own the actual buildings, either because they want to keep their balance sheets unleveraged or because they simply could not start their franchise while also buying the building simultaneously.

6) Mixed-Use Properties: Mixed-use properties combine two or more different types of real estate (such as residential, commercial, and retail spaces) within a single development. This approach offers diversification and potential synergies between different property types. Consider factors such as the demand for mixed-use developments, zoning regulations, tenant mix, and market dynamics. For example, many current trends mix retail with single and multi-family housing.

7) Special Purpose Properties: Special purpose properties include assets designed for specific uses, such as healthcare facilities, educational institutions, self-storage facilities, data centers, banking, or recreational properties. Investing in these properties requires understanding the specific industry or sector’s unique characteristics and demand drivers. Again, where there are challenges, we can constantly find opportunities. For example, the rise of pickleball has come at a time when malls have found it increasingly difficult to attract anchor tenants. Some have leaped industries turning vast spaces from retail to pickleball courts. Opportunity creates diversity!

It’s crucial to conduct thorough due diligence, analyze market conditions, evaluate potential risks and returns, and consider factors such as location, property condition, tenant profiles, lease terms, and market demand when selecting a target commercial property to invest your time and money. Consulting with professionals, such as real estate agents, brokers, or investment advisors, can also provide valuable insights and guidance in your decision-making process.

“Property ownership sustains long-term value to you and your shareholders or family. Understanding the cash flow potential of a commercial investment property is vital for you to make informed decisions and achieve long-term success in your portfolio.” - Ali Choudhri, CEO of Jetall Capital.

Investing in commercial properties offers numerous opportunities for wealth creation but also carries substantial risks. However, by employing diligent research and analysis, prospective investors can mitigate these risks and identify properties with strong cash flow potential and a high likelihood of long-term value appreciation.

About Jetall Capital

Sourced photo

Jetall Capital is a family-owned real estate investment and management firm that commenced operations in 1961 in London, England through its principals. Lead by Mr. Ali Choudhri, Jetall Capital is a family-owned real estate investment and management firm, which is now the largest private owner of commercial office space in Houston’s Galleria submarket – managing over 1 million square feet of high-value property throughout Houston, Austin, and Dallas.

Contact:

Jetall Capital

Aiden Porter

mediaops@jetallcompanies.com

713-789-7654