The Importance of Diversifying Your Investment Portfolio

In the ever-changing landscape of financial markets, the quest for a well-balanced and diversified investment portfolio remains crucial for investors seeking long-term success. As we unveil the significance of portfolio diversification, it becomes evident that this strategy is more than just a trend; it’s a fundamental principle for mitigating risks and enhancing overall returns.

In recent times, the financial landscape has experienced fluctuations and uncertainties that underline the importance of a diversified investment portfolio. Investors are navigating through an ever-evolving saga of market dynamics, influenced by various factors such as economic trends, geopolitical events, and global pandemics.

Mitigating Risks Through Diversification

Diversifying your investment portfolio involves spreading your investments across different asset classes, industries, and geographic regions. This approach acts as a shield against the inherent risks associated with specific investments. By allocating assets strategically, investors can minimize the impact of a poor-performing asset on the overall portfolio.

Maximizing Returns in Various Market Conditions

One of the primary advantages of portfolio diversification is its ability to maximize returns in different market conditions. While some sectors may face challenges, others may thrive. A diversified portfolio ensures that you have exposure to a variety of assets, allowing you to capitalize on opportunities that arise, even in the face of an ever-evolving market.

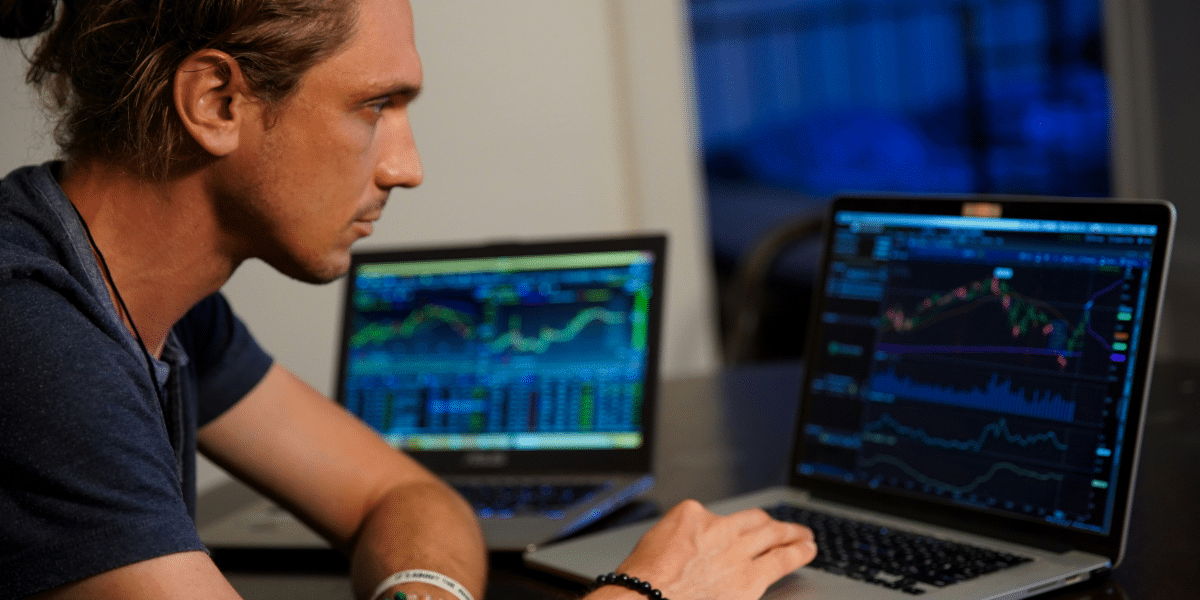

Strategic Asset Allocation

To achieve effective diversification, investors must engage in strategic asset allocation. This involves analyzing their financial goals, risk tolerance, and investment horizon to determine the optimal mix of assets. This process is not a one-time event but rather an ongoing quest to align the portfolio with changing market conditions and personal financial objectives.

Navigating Global Trends

Given the interconnectedness of the global economy, it is crucial to consider international investments in your diversified portfolio. By doing so, you can navigate through the twists and turns of global economic trends. This approach helps in mitigating risks associated with regional economic downturns and capitalizing on opportunities that may arise in different parts of the world.

Portfolio diversification remains a cornerstone of sound investment strategy. In the quest for financial success, investors must recognize the ever-evolving nature of markets and adapt their portfolios accordingly. By adhering to federal compliance guidelines and embracing strategic asset allocation, investors can build resilient portfolios that stand the test of time. As we navigate the complex landscape of financial markets, the saga of portfolio diversification continues to unfold as a key factor in achieving long-term investment objectives.